Disclosure Statement

Enrich Limited, Enrich GI Limited and Enrich Mortgages Limited all trade in New Zealand under the brand name Enrich Financial.

Enrich Limited holds a Financial Advice Provider Licence (class 2) issued by the Financial Markets Authority to provide financial advice services in New Zealand, and additionally Enrich GI Limited and Enrich Mortgages Limited are authorised bodies under this licence.

- Enrich Limited – provides Investment, KiwiSaver, Wealth, Financial Wellbeing, Retirement Planning and Business Strategy Advice to its clients. Its Financial Services Provider registration number is FSP1005147.

- Enrich GI Limited – provides the full suite of General Insurances and Life Insurance advice to its clients. Its Financial Services Provider registration number is FSP1006361.

- Enrich Mortgages Limited – provides residential lending (mortgage and consumer credit advice) to its clients. Its Financial Services Provider registration number is FSP1006362.

Enrich Financial provides this range of financial advice services through our registered Financial Advisers, and if there is need for advice that crosses into separate categories to ensure you are receiving the best possible outcomes for your individual needs and requirements, your adviser will provide transparent and timely notification of this.

Contact Information.

This FAP Disclosure statement provides relevant information about the financial advice services that Enrich Financial (herein Enrich, we, our and us) provide. It should help you decide whether to use our advisers and whether to follow their financial advice.

You can contact Enrich on:

Phone:

Email:

Office:

Postal:

General Conditions.

- Enrich provides financial advice services on the financial advice products listed below in the section (“Nature and Scope of Advice”); and

- Enrich will employ Financial Adviser’s who are qualified to give advice on behalf of Enrich.

Standard Conditions.

- Record Keeping – We must maintain adequate records in relation to financial advice given; and

- Internal Complaints Process – We must have an internal process for resolving customer complaints relating to its financial advice service.

- Regulatory returns – We must provide information periodically, on an ongoing basis, or when requested by the Financial Markets Authority (FMA).

- Outsourcing – Where we outsource a system or process necessary to the provision of our financial advice service, we must ensure the provider is capable of performing the service to the standard required to meet our market obligations.

- Business continuity and Technology – We must have an maintain a business continuity plan that is appropriate for the scale and scope of our financial advice service. We must also ensure our technology systems – confidentiality, integrity, availability or information and/or information systems is maintained.

- Ongoing Requirements – We must at all times continue to satisfy the requirements set out in the FMC Act.

- Notification of material changes – We must notify the FMA within 10 working days of implementing any material change to the nature of, or manner in which we provide our financial advice service.

Nature and Scope of Advice.

Enrich and its advisers provide advice to clients about their Investments, KiwiSaver, Mortgages, Life Insurance, General Insurances, Retirement Planning, Wealth Management and Business Strategy.

We provide financial advice about products from certain providers. They are as follows:

Investments

| Milford Asset Management | SuperLife Invest – a member of the NZX Group |

| Generate Investment Management | Synergy Investments |

| Consilium NZ Limited |

KiwiSaver

| Generate Investment Management | SuperLife KiwiSaver – a member of the NZX Group |

| Milford Asset Management | KiwiWRAP – by Consilium NZ Limited |

Mortgages – To be updated

Life Insurance – To be updated

General Insurance – To be updated

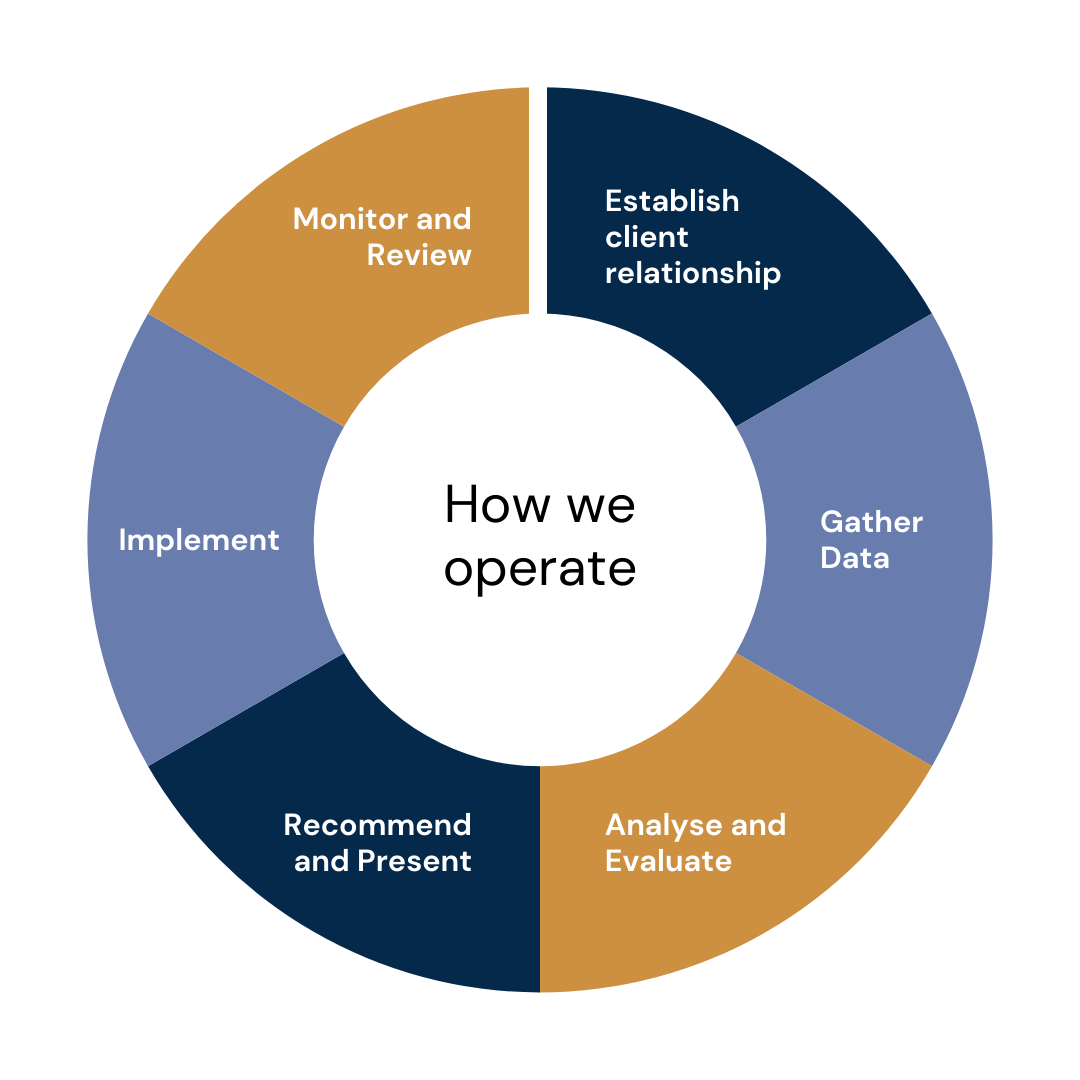

How we Operate.

Our Enrich financial advisers prioritize clients interests above their own. We follow an industry recognised professional advice process, to ensure recommendations are made on the basis of our clients needs and requirements.

Reliability History.

We have not been subject to a reliability event. A reliability event is something that might materially influence you in deciding whether to seek financial advice from us. As an example, it would include a successful regulatory action against us relating to the financial services we provide.

Fees and Other Charges.

The nature and total amount of any fees that you will be charged for advice and/or services and when and how they must be paid, will be disclosed to our clients by the relevant financial adviser.

Enrich may be remunerated for the implementation of, and retention of, some financial products such as insurances or mortgages by the product provider. In many cases an upfront planning or advice fee is not required. Ongoing adviser fees for investment products and KiwiSaver plans are most often paid for through the product provider.

Planning and Advice Fees.

- We may charge a fee for preparing Personal or Business Insurance or Investment plans, up to a maximum of $4,000 +GST.

- We will agree the amount or basis of the calculation of any fee payable upfront and confirm the amount in our scope of engagement.

- We ask that you pay or reimburse us for all charges or fees in relation to services provided as outlined in the invoice/s provided to you within 14 days.

- Where we have not charged a planning or advice fee in advance of advice and you have applied for a financial product but have not subsequently accepted the product offered, assuming the terms are reasonable, or if you fail to complete the application process through no fault of the product provider or Enrich, or if you cancel the financial product within 24 months of its start date, we reserve the right to charge you a planning fee of between $150 and $350 per hour +GST depending on which Enrich adviser/s you used (this is based on our time relating to the advice and implementation process for that product) up to a maximum of $4,000 +GST.

- For any insurance product that we must refund some or all of any commission received, you are required to pay a fee equal to the amount of the clawback within 14 days of Enrich providing you such notification.

- In the case of a mortgage product arranged through Enrich, where a client moves or pays off some or all of the loan within 36 months, most lenders claw back a proportion of the commission initially paid to Enrich, and we will require you to repay the amount of that clawback, within 14 days of Enrich providing you such notification.

Consultancy Fees.

- Where one of our Advisers is working on a consultancy basis, (generally where no financial product will be purchased as part of the advice or if any commission payable for such a product is too low to adequately compensate Enrich for its advisers time), Enrich will charge you an hourly rate of between $150 and $350 +GST.

- A minimum of five hours (or a maximum of $1,500 +GST) should be allowed for consultancy arrangements, to cover any meeting/s, set up and research, resulting documentation and report writing/file notes.

- Enrich will confirm the amount or basis for calculation of any fee payable upfront and confirm the amount in our scope of engagement if the fee for consultancy will be more than $1,500 +GST.

Commission for Insurance Products.

- Typically for insurance we are remunerated by receiving commission directly from the product providers.

- Once we understand your needs and requirements, we will provide specific information in relation to the policy or policies recommended for you, and also the remuneration we may receive as a result of you agreeing to our recommendations and implementing the advice.

- Typical Guidelines:

| Type of Commission: | Typical Range: |

| Upfront Commission (once implemented) | 30%-230% of the first years premium |

| Ongoing Commission | 5%-50% of subsequent years premium |

Example: Should you agree to implement a policy with an annual premium of $1,000, Enrich may receive between $300-$2,300 in the first year, and $50-$500 in subsequent years.

Commission for Mortgage Products.

- Mortgage Lenders usually pay Enrich commission of between 0.60% – 0.85% of the mortgage arranged, and trail commission after 12 months of up to 0.20% per annum of the reduced principal owing. For complex arrangements we reserve the right to charge you an additional fee, which would be transparently and completely disclosed and discussed with you.

Example: If you agree to implement a mortgage recommendation Enrich has provided you with of $500,000, Enrich would receive between $3,000 and $4,250 upon draw down of your mortgage, with up to $1,000 per annum in subsequent years. If your Enrich adviser will receive a percentage of this commission, it will be disclosed to you directly upfront.

KiwiSaver, Superannuation Plans and Investment Products.

- Typically KiwiSaver and superannuation providers, along with Investment Fund Managers pay Enrich a monthly (sometimes quarterly) adviser fee or trail commission (all disclosed at the time of recommendations being provided to you) of between 0.20% and 1.05% per annum based on the funds invested. Some KiwiSaver providers also pay an upfront referral fee of up to $300.

- Ongoing Services Fee – Between 0.00 – 0.75% depending on Investment type and Provider.

- Enrich may charge an upfront implementation fee of 0.75% – 3.00% of the amount invested for superannuation plans and investment products. We reserve the right to charge a 1.00% exit fee on a total funds withdrawal if you have invested on a particular retail platform.

- Clawback – where you exit an investment or KiwiSaver product implemented by Enrich within a certain time frame (usually 24 months), the provider may recover commissions initially paid to Enrich. We reserve the right to recover this amount from you as the instigator of the commission payment, and if so will invoice you accordingly.

Example: if you have a KiwiSaver plan with a fund value of $50,000 and where we are the noted Financial Adviser, our ongoing adviser fee may be between $8 and $21 per month.

Enrich has two types of Financial Advisers.

Salaried Advisers – These advisers are paid a salary, with the possibility of annual bonuses based on their performance.

Contracted Advisers – These advisers receive a percentage of the commission that is paid to Enrich for work completed by them, with the possibility of annual bonuses based on their performance.

Commissions and Conflicts of Interest.

Enrich may receive a commission and/or benefit from insurance providers whose policies our customers choose to take up.

From time to time most product provider’s provide competitions and other incentives schemes based on the volume of business placed with them. Prizes and other benefits offered by these product providers include proprietary software, attendance at industry conferences both here and overseas, travel benefits and other similar incentives.

Enrich has processes in place to ensure our financial advisers understand their duties (as summarised in this disclosure) and put your best interests first in relation to all given advice, and they receive this conflict management training annually.

Duties Information.

Enrich and our advisers have duties under the Financial Markets Conduct Act 2013 relating to the way that we give advice. We are required to:

- give priority to your interests by taking all reasonable steps to make sure our advice isn’t materially influenced by our own interests

- exercise care, diligence, and skill when providing you with advice

- meet applicable standards of competence, knowledge and skill set by the Code of Professional Conduct for Financial Advice Services (these are designed to make sure that we have the expertise needed to provide you with advice)

- meet standards of ethical behaviour, conduct and client care set by the Code of Professional Conduct for Financial Advice Services (these are designed to make sure we treat you as we should, and give you suitable advice).

This is only a summary of the duties that we have. More information is available by contacting us, or by visiting the Financial Markets Authority website at www.fma.govt.nz/compliance/financial-advice/.

Complaint Handling and Dispute Resolution.

Our mission is to provide you with exceptional levels of service and support at all times. If you have a complaint or encounter a problem please let us know as soon as you can, as your feedback helps us continue to improve the products and services we offer.

We are committed to sorting things out as quickly and as fairly as possible, and we assure you that we will do our best to address your complaint quickly and sincerely. Full details of our complaints’ procedure are available at all Enrich locations or online at https://enrich.financial/compliments-complaints/.

Resolving a complaint or problem

We have a well-established and highly effective escalation process, meaning we will work with you to address your concern as quickly as possible, while still providing you options to take the matter further if you are unhappy with the outcome.

Your first point of call if you have a concern is to visit your local Enrich location, call us or send us your feedback through our online Complaint Form.

If the problem is not solved there to your satisfaction, you may contact our Enrich Compliance Officer who will revisit your issues directly with you.

How to contact us:

- Phone: 0800 454 870

- Branch: Locations

- Online Form: Complaint Form

- Postal Address: PO Box 11094, Te Aro, Wellington 6142

Independent Disputes Resolution

If you are not satisfied with the resolution suggested by our internal Complaint Resolution Process, you can request a free, independent review from our external dispute resolution provider, Financial Services Complaints Limited (FSCL). We belong to their approved dispute resolution scheme, which is an approved scheme under the Financial Service Providers (Registration and Dispute Resolution) Act 2008. Our membership number is 9067.

You can find out more about FSCL by calling them on 0800 347 257 or visiting them online here.

You can contact FSCL at:

- Phone: 0800 347 257, or 04 472 3725

- Email: info@fscl.org.nz

- Website: www.fscl.org.nz

- Postal Address: PO Box 5967, Lambton Quay, Wellington 6145

Controls.

Key Control

Complaints Register

How Implemented

The CEO will be updated by the Register holder of any complaint which highlights a deficiency with Enrich’s disclosure statement and make corrections.

Responsibility

CEO

Related Policies.

- Code of Conduct Policy

- Duties Statement

- Conflict of Interest Policy

- Product Provider Selection Policy

Other References.

- Financial Markets Conduct Act 2013

- Financial Services Legislation Amendment Act 2019

Review of Disclosure Statement.

This disclosure statement and supporting procedures will be reviewed at least annually or whenever a change or event necessitates.

Approval.

Chief Executive Officer: Rodney Varga

Version Control.

2025.11

The single most important ingredient in the recipe for success is transparency because transparency builds trust.”

Denise Morrison